Вавада казино рабочее зеркало и вход

Онлайн казино Vavada основано в 2017 году и является одним из самых распространенных брендов в РФ и странах СНГ. Сотни тысяч пользователей предпочитают клуб конкурентам, ведь здесь вы найдете больше 4500 игр, бонусные предложения, круглосуточную поддержку и гарантии честного результата.

У проекта есть лицензия Кюрасао. Поэтому администрация имеет возможность гарантировать качественное обслуживание. Работы бренда регулируется игорной комиссией. Владельцы компании при желании не смогут повлиять на геймплей. А в случае нарушения условий заведение рискует получить штраф или лишиться сертификата. За более 6 лет существования клуб наработал хорошую репутацию и не готов ею рисковать.

Главные плюсы – быстрая регистрация, бонусные предложения, игровые автоматы и высокая надежность результата. А удобный интерфейс и круглосуточная поддержка позволят разобраться в процессе и правилах клуба. Дизайн выполнен в темных тонах с розовыми элементами, что сделает процесс еще удобнее и комфортнее.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Зеркало Вавада

Воспользуйтесь рабочим зеркалом Вавада ru и получите доступ к функционалу. Провайдеры банят подобные ресурсы. Под блокировку подходят и проверенные бренды с лицензией. Поэтому сам факт таких проблем не станет причиной ухудшения качества обслуживания.

Чтобы найти зеркало Casino Vavada на сегодняшний день, воспользуйтесь:

- Тематическими порталами;

- Промо рассылкой;

- Социальными сетями.

Разработчики добавляют новый домен, который еще не заблокирован. Посетители из России смогут зайти на него без VPN. Администрация следит за работоспособностью доменов и быстро выпускает обновленные.

Вход и регистрацияРегистрация на сайте

Пройдите регистрацию в онлайн казино Вавада и проверьте удачу в лицензированных аппаратах. Вам достаточно:

- Открыть главную страницу;

- Нажать на кнопку “Регистрация”;

- Указать телефон или email;

- Придумать пароль;

- Выбрать валюту;

- Прочитать правила.

Вам необходимо подтвердить email и номер. Компания запрашивает подтверждение остальных данных в профиле. Пользоваться услугами площадки могут только совершеннолетние гости. Указывать информацию нужно достоверную, которую в дальнейшем будет реально подтвердить.

В личном кабинете игрокам доступны персональные данные, процедура верификации, актуальные акции, пополнение баланса и остальные функции. Процедура верификации может потребоваться при подозрении в мошенничестве. В других случаях менеджеры стараются не беспокоить посетителей.

Чтобы пройти верификацию, пройдите в учетную запись и прикрепите фотографию документа. Паспортные данные должны быть отчётливо видны. Проверка занимает несколько минут. После менеджер снимет ограничения с учетной записи.

Бонусы

Бонусы – предложения от администрации, дающие дополнительные условия для успешной игры. Множество интересных акций помогут вам забрать еще больше выгоды от бренда. Откройте соответствующий раздел в профиле и активируйте промокоды Вавада казино на депозит, либо выберите другое доступное промо.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

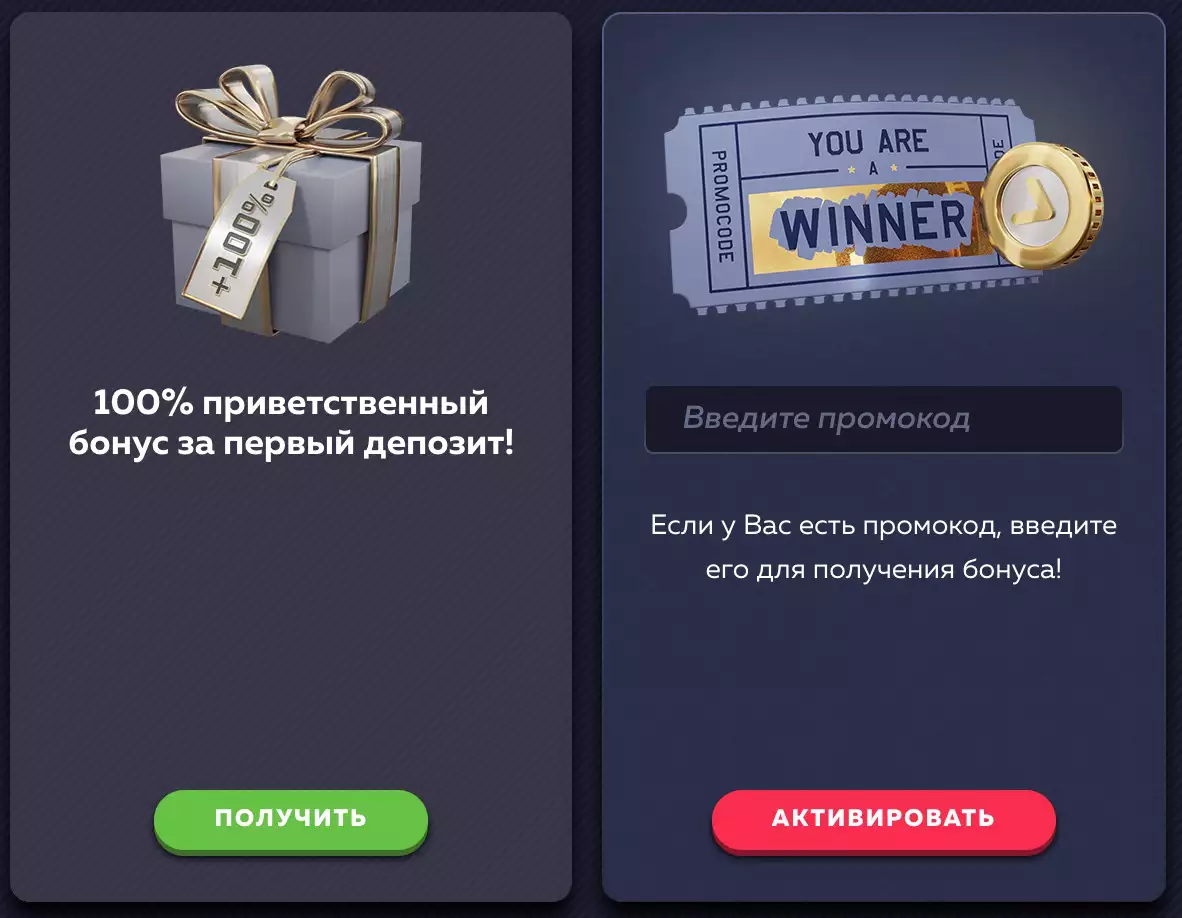

Приветственный бонус за регистрацию

Воспользуйтесь бонусами Вавада казино на сегодня и заберите дополнительную выгоду от ставок. Бренд предлагает гостям множество интересных акций, доступных на любом уровне. Награды предоставляются как новичкам, так и опытным гемблерам. После регистрации вам дается 100% на первый депозит.

Приветственная акция дает до 1000$ на старте аккаунта. Средства необходимо отыграть по вейджеру x35. Вывод возможен только после отыгрыша. В противном случае заявка на выплату аннулирует награду.

Промокоды Вавада

Новичкам предлагаются промокоды на сегодня без отыгрыша в Вавада и остальные награды. Активируйте код в личном кабинете и заберите подарок. Найти актуальные промокоды можно через:

- Сайты партнеров

- Персональные рассылки

- Телеграм канал

Подпишитесь на социальные сети бренда и будьте в курсе последних акций. Лотереи, розыгрыши, раздачи промокодов и остальные события принесут вам дополнительную выгоду.

Кэшбек

В Vavada действует кэшбек 10%. Менеджеры возвращают клиентам 10% от проигранных ставок. Он зачисляется каждый месяц 1-го числа и доступен только гемблерам, чьи выигрыши меньше проигрышей. Заберите кэшбек в течение 14 дней после появления и отыграйте его по вейджеру x5, чтобы вывести заработанные деньги.

Программа лояльности

Каждый месяц Vavada присваивает гостю статус. Наберите необходимую сумму ставок и заработайте соответствующий уровень. В зависимости от статуса профиля пользователям предлагается уникальные турнирам, персональные награды и многое другое.

Мобильное приложение

Пользуйтесь услугами и оставайтесь в игре в любое удобное время. Чтобы скачать Vavada на телефон, достаточно:

- Открыть онлайн чат;

- Обратиться к менеджеру;

- Использовать ссылку для загрузки;

- Скачать и установить приложение.

Мобильное приложение Vavada обеспечивает комфортный процесс. Полный функционал, бонусные предложения, тысячи слотов и другие особенности бренда с удобным интерфейсом помогут сделать геймплей максимально комфортным. Загружаемое ПО не требует использование рабочих зеркал, поэтому вам не нужно их самостоятельно искать.

Клиентам доступен мобильный сайт Вавада, для запуска которого не нужно загружать файлы. Функционал тот же, но при блокировке домена вам нужно найти зеркало. Остальные услуги и опции одинаковые.

Игровые автоматы

Проверьте удачу в игровых автоматах Vavada Casino и имейте шанс на выигрыш денег. Более 4500 игр от лучших разработчиков станут подходящим вариантом для ценителей качественного геймплея:

- Онлайн слоты;

- Live дилеры;

- Настольные игры;

- Instant Games и многие другие.

Выберите подходящее развлечение и проверьте свою удачу. Лицензированные разработчики гарантируют честный геймплей в Вавада на деньги, что дает шанс на крупный выигрыш. Провайдеры фиксируют технические характеристики, поэтому возможность на выплату будет даже у новичков.

Book Of Lady – Endorphina. RTP – 96.03%. Слот про жизнь богатой девушки. Дорогие украшения, животные, элементы гардероба и другие тематические изображения представлены в качестве символов на экране. Три Scatter на линиях начинают раунд с бесплатными вращениями.

Resident – Igrosoft. RTP – 95%. История про агента под прикрытием. Классический слот с 3 барабанами и оформлением из 90-х с раундом с фриспинами и суперпризом.

Также пользователям доступны Live игры Вавада – покер, рулетка, баккара, блэкджек и многое другое. Сыграйте с живым дилером и получите незабываемый опыт оффлайн казино прямо через компьютер или мобильное устройство. Результат раунда определяется картами и рулеткой. Соответственно, крупье не сможет повлиять на исход или подстроить его.

Демо-режим предлагает клиентам бесплатный геймплей. Вам не придется использовать реальные средства. Пользователь не рискует и набирается опыта, который будет полезен при дальнейшей игре.

Техническая поддержка

Служба поддержки Vavada Casino позволит вам разобраться в игровом процессе и правилах клуба. Менеджеры работают круглосуточно и принимают заявки гостей через:

- Горячую линию;

- Электронную почту;

- Онлайн чат на сайте;

- Телеграм канал и многое другое.

Найти номер оператора Vavada и остальные контактные данные вы найдете в разделе “Написать нам”. Поддержка готова в любое время суток обработать ваш вопрос и максимально быстро приступить к решению проблемы. Специалисты помогут вам в выводе, бонусах, пополнении счета и остальных функциях.

Партнерская программа

Хотите зарабатывать без рисков? Для этого существует партнерская программа Vavada, которая награждает вебмастеров за привлечение посетителей в казино. Разработчики подготовили выгодные условия сотрудничества через RevShare (до 50%) или по CPA. Условия обговариваются отдельно. Администрация всегда идет навстречу пользователям и готова обсуждать персональные условия и поможет на старте.

Зарегистрироваться в партнерской программе нужно через саппорт. Заполните форму и подключите кабинет. Вас сопровождает аффилиат менеджер, который в круглосуточном режиме поможет разобраться в правилах и подобрать выбрать наилучший источник трафика. Партнерка позволяет выбрать RS – отчисления от проигрышей привлеченных клиентов, либо же CPA – фиксированная награда за First Deposit.

Способы пополнения и вывода средств

Чтобы играть в Vavada на реальные деньги, необходимо пополнить счет через:

- VISA;

- MasterCard;

- МИР;

- Piastrix;

- Ethereum;

- Neteller;

- Skrill;

- Bitcoin;

- Tether и прочие способы оплаты.

Минимальное пополнение– от 50 RUB. Средства зачисляются сразу же и без комиссии. Чтобы заказать вывод с Вавады, достаточно зайти в профиль и выбрать метод оплаты. Минимальная сумма – от 1000 рублей. Заявка будет обработана в течение суток. Возможны задержки до двух дней, когда ситуация будет требовать дополнительных проверок.

Лимит на выплаты устанавливается для статусов:

- Новичок – 1000$;

- Игрок – 1000$;

- Бронзовый– 1500$;

- Серебряный– 2000$;

- Золотой– 5000$;

- Платиновый – 10000$.

Лимит на выплаты криптовалютой составляет 1 000 000 USD в месяц.

Список рабочих зеркал Вавада

Официальный сайтFAQ

Как отыграть приветственный бонус 100% на 1-й депозит?

После создания профиля игрокам дается до 90 000 бонусных рублей на первый депозит. Вывести зачисленные средства можно только после отыгрыша по вейджеру x35. Максимальный кэш аут – до x10 от изначальной суммы.

Как забрать кэшбек?

Администрация возвращает 10% от проигранных денег за текущий период. Награда зачисляется первого числа в месяце. Успейте использовать кэшбек, в течение 14 суток после отображения в аккаунте, чтобы не потерять выгоду. Вейджер – x5.

Как долго выводятся средства?

Среднее время ожидания денег – до 24 часов. Если гость выводит от 1000 долларов за транзакцию, тогда срок увеличивается до 2 дней. Однако многим клиентам выводят уже в течение пары часов.

Как активировать промокод?

Ввести промокод можно в личном кабинете. Войдите в профиль и откройте соответствующую вкладку, чтобы активировать код и получить подарок. Коды периодически появляются на тематических порталах или раздаются в социальных сетях.

Как загрузить приложение?

Чтобы скачать ПО, вам необходимо написать в службу поддержки. Менеджер выдаст ссылку для скачивания и поможет разобраться с установкой.

Отзывы

-

Всё понравилось. Прикольно вращать барабаны, частенько выигрываю кеш, хоть и немного. Не рискую особо и используя стратегию Мартингейл.

-

Забрал спины и не думал, что окажется легко прокрутить вейджер. Слот дающий, часто выпадает Wild и множители. Вчера вот вывел 2к рублей.

-

Нравятся гонки на бесплатные спины. Правила простенькие, а фонды огромные. Прикольно, что много мест с призами. Да и мероприятия отличаются для разных VIP-статусов.

-

Удивился компетентной техподдержке. Мило пообщался с оператором Ксения. Всё рассказала и доходчиво объяснила. На других ресурсах общаешься с ботами, а тут реальные люди, да и вежливые.

-

Для хайроллеров не сильно приятные лимиты. Хотя с повышением вип-уровня всё меняется, да и договориться с саппортом легко.